A amortization schedule is a table or chart showing each payment on an amortizing loan, including how much of each payment is interest and the amount going towards the principal balance. Thankfully, there are many freely available websites and calculators that create amortization schedules automatically. The downside to this is people are less informed on the mathematical calculations involved in creating the schedule. We provide the step-by-step calculations below for a simple fixed-rate mortgage.

Let's say you are purchasing a new home for $280,000 with a $30,000 down payment. Your bank agrees to provide you with a $250,000 mortgage at a fixed interest rate of 5% for 30 years. What is your monthly payment? How much money are you paying towards interest and principal each month? Let's find out.

Determine the total number of payments

In this example, you have to make one payment per month for 30 years. This means you will make 360 payments over the course of the mortgage (12 x 30 = 360).

Determining a monthly payment

If there were no interest rate, determining your monthly rate would be simple: divide the loan amount by the number of payments ($250,000 / 360 = $694.44). Obviously the bank has to make money so the mortgage comes with a 5% interest rate.

It is important to note the 5% is an annual interest rate. Since all the following calculations are based on a monthly payment schedule, the annual rate needs to be converted to a monthly rate. The monthly interest rate would be 0.416% (5% / 12 = 0.416%).

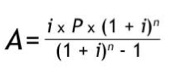

Determining the monthly payment to account for interest requires a complicated formula shown below.

A is the monthly payment, P is the loan's initial amount, i is the monthly interest rate, and n is the

total number of payments.

Using our numbers (P = 250,000, i = 0.416%, n = 360), the formula yields a monthly payment of $1,342.05.

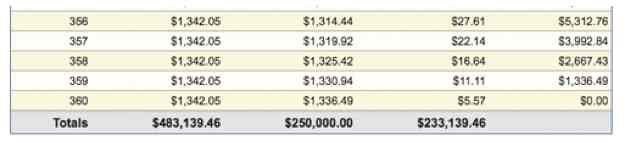

Determining the total interest

We can now calculate the total cost of the loan since you will make 360 payments of $1,342.05. The total cost is approximately $483,139 (actually $483,139.46 if you don't round the monthly payment to two decimals). Subtracting away the original loan amount ($250,000) leaves us with the amount of interest: approximately $233,139. So even though the interest rate is only 5%, you almost pay as much in interest as the purchase price!

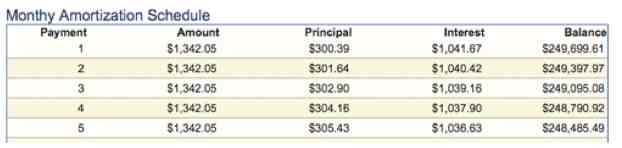

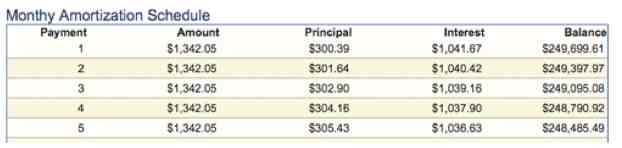

Determining the breakdown of each monthly payment

Even though the monthly payment is fixed, the amount of money paid to interest varies each month. The remaining amount is used to pay off the loan itself. The complicated formula above ensures that after 360 payments, the mortgage balance will be $0.

For the first payment, we already know the total amount is $1,342.05. To determine how much of that goes toward interest, we multiply the remaining balance ($250,000) by the monthly interest rate: 250,000 x 0.416% = $1,041.67. The rest goes toward the mortgage balance ($1,342.05 - $1,041.67 = $300.39). So after the first payment, the remaining amount on the mortgage is $249,699.61 ($250,000 - $300.39 = $249,699.61).

The second payment's breakdown is similar except the mortgage balance has decreased. So the portion of the payment going toward interest is now slightly less: $1,040.42 ($249,699.61 * 0.416% = $1,040.42).

This process of calculating interest based on the remaining balance continues until the mortgage is paid off. So each month the amount of interest declines and the amount going to paying off the loan increases. After 360 payments, the mortgage is fully paid off.

It is important to note that our calculations do not include any additional costs such as closing costs, property taxes, or mortgage insurance.